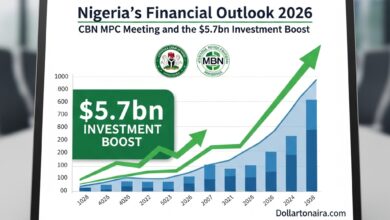

Nigeria’s Economic Outlook: Naira Stability and Market Performance as 2025 Ends

As the global financial markets wind down for the year, Nigeria’s economic landscape is showing a mix of resilience and strategic recovery. For investors and businesses tracking the Naira to Dollar exchange rates, the final quarter of 2025 has provided significant data points that suggest a shifting tide in the country’s monetary policy.

The Exchange Rate Situation: Naira Gains Ground

The Nigerian Naira (NGN) has maintained a relatively stable trajectory against the US Dollar (USD) throughout December. Following the Central Bank of Nigeria’s (CBN) aggressive interventions and the unification of exchange rate windows, the gap between the official and parallel markets has narrowed significantly.

- Official Window (NAFEM): The Naira closed the year trading within the range of ₦1,430 – ₦1,450/$1.

- Parallel Market: The street rate hovered around ₦1,480 – ₦1,490/$1, representing a drastic reduction in volatility.

Experts attribute this stability to the improved inflow of Foreign Portfolio Investments (FPIs) and a consistent rise in crude oil production levels, which have bolstered Nigeria’s foreign exchange reserves.

Stock Market Brilliance: A Bullish Year for NGX

The Nigerian Exchange Limited (NGX) has emerged as one of the best-performing markets in Africa this year. The All-Share Index (ASI) saw an unprecedented surge, driven largely by the banking and industrial sectors.

- Market Capitalization: Crossing the ₦99 trillion mark.

- Top Gainers: Tier-1 banks recorded over 40% year-on-year growth in share value, buoyed by high-interest rate environments.

Inflation and Macroeconomic Indicators

One of the most significant financial highlights for today is the steady decline in the inflation rate. From the highs experienced in early 2024, the National Bureau of Statistics (NBS) reports that headline inflation has cooled down to approximately 14.45%.

This disinflationary trend is a positive signal for businesses, as it indicates an increase in consumer purchasing power heading into the new year.

Don’t Miss These Financial Updates:

Stay informed with our latest in-depth analysis and market forecasts:

- Naira to Dollar Forecast 2026: Will the Exchange Rate Drop Below ₦1,400?

- New CBN Monetary Policy: How Interest Rate Hikes Will Affect Your Savings in 2026.

- Top 5 Nigerian Stocks to Watch in Q1 2026: Banking vs. Telecom Sectors.

- Inflation Report: Why Food Prices Are Falling Across Nigeria Despite Forex Fluctuations.

- Naira vs. Cedi vs. Rand: How Nigeria’s Currency Performed Against African Peers.

- The Future of eNaira: Can Nigeria’s Digital Currency Help Stabilize the Forex Market?

- US Federal Reserve Decisions: How Global Interest Rates Are Influencing the Naira Value.

- Hedge Against Volatility: How Small Businesses Can Survive Dollar Fluctuations in 2026.

- Surging Foreign Reserves: What Nigeria’s $45 Billion Buffer Means for Investors.

- Step-by-Step Guide: How to Legally Buy Dollars for International Transactions in Nigeria.

Conclusion

As we transition into 2026, the focus remains on the CBN’s “Price Stability” mandate. Analysts predict that if the current foreign reserve accretion continues currently sitting at $45.48 billion the Naira may see further appreciation in the coming months.