Top 5 Nigerian Stocks to Watch in Q1 2026: Banking vs. Telecom Sectors

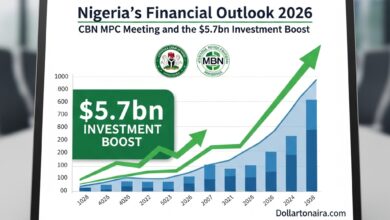

The Nigerian Exchange Limited (NGX) has entered 2026 with a strong bullish momentum. After a record-breaking performance in 2025, where market capitalization neared the ₦100 trillion mark, savvy investors are now looking for the best positions for the first quarter of the year.

If you are looking to diversify your portfolio, here are the top 5 sectors and stocks to keep a close eye on.

1. Zenith Bank PLC (ZENITHBANK)

Zenith Bank remains a leader in the Tier-1 banking category. With the CBN’s recent interest rate hikes to 28.5%, Zenith is well-positioned to increase its interest income. Their consistent dividend payout history makes them a favorite for “income investors.”

2. MTN Nigeria Communications (MTNN)

As Nigeria continues its digital transformation, MTN Nigeria remains a powerhouse. Despite forex challenges in the past, their expansion into 5G technology and the growth of MoMo PSB (Fintech arm) provide a solid foundation for long-term growth in 2026.

3. Dangote Cement PLC (DANGCEMENT)

With the government’s renewed focus on infrastructure development and the completion of major refinery projects, the demand for cement is expected to surge. Dangote Cement continues to dominate the market share, making it a “must-watch” industrial stock.

4. Guaranty Trust Holding Company (GTCO)

GTCO is known for its operational efficiency and strong retail banking presence. Their transition into a full holding company allows them to explore opportunities in asset management and pension funds, providing multiple revenue streams that appeal to institutional investors.

5. Seplat Energy (SEPLAT)

For those looking to gain from the energy sector, Seplat is a top contender. As global oil prices remain stable and Nigeria’s domestic gas production increases, Seplat’s strategic acquisitions in the oil and gas space position it for significant capital appreciation.

Investor Advice: Diversification is Key

While the Nigerian stock market shows great promise in Q1 2026, experts advise investors to balance their portfolios. Combining high-growth telecom stocks with stable, dividend-paying banking stocks can help mitigate risks associated with market volatility.

Disclaimer: The information provided here is for educational purposes only and does not constitute financial advice. Always consult with a certified financial advisor before making investment decisions.